Landlords will most likely not make the legislation in their very own hand and you can evict an occupant by use of force otherwise illegal function. For example, a property owner never play with risks from violence, lose an occupant’s possessions, secure the brand new occupant out from the flat, otherwise willfully cease important features such liquid otherwise heat. An occupant must upgrade the new property owner of your label of every renter within thirty day period of the renter stepping into the brand new flat otherwise 30 days out of a property owner’s request this informative article.

Must i send currency on my household country thanks to these types of banking companies?

Giovanna and you may Wi People work with a little family members office within the Panama enabling those with things from immigration, corporate formations, and you can banking. Unless if not decided, the brand new tenant shall take his dwelling equipment just since the a property. D. Which part will not implement if the court order excluding an excellent person is given ex parte. Allow a tenant or his registered broker otherwise lawyer so you can check such tenant’s facts out of deductions when throughout the normal organization instances. B. In case there is the fresh selling of one’s site, the brand new landlord shall notify the new renter of such sale and you can divulge for the tenant the name and you can address of your own purchaser and you may a telephone number of which such as consumer are available.

Precisely what does the fresh Given rates statement indicate to own bank account bonuses?

Go into which password for many who qualify for an automatic 90-day extension of your energy to file their return because your spouse died within thirty days before the deadline of your own return. If you otherwise your spouse (in the event the married processing jointly) managed otherwise got access to an apartment otherwise life house inside Yonkers during the people element of 2024 (even though you myself used those individuals life style home for the an element of the 12 months), you must mark an enthusiastic X regarding the Yes package online D2(1). Input the newest applicable box the number of days you and your lady (in the event the submitting a shared go back) lived in Yonkers throughout the 2024. Concurrently, you have to make the right entry from the Item F if you be eligible for a 90-time expansion of energy to help you file your own return because your mate died inside thirty days before due date of the come back.

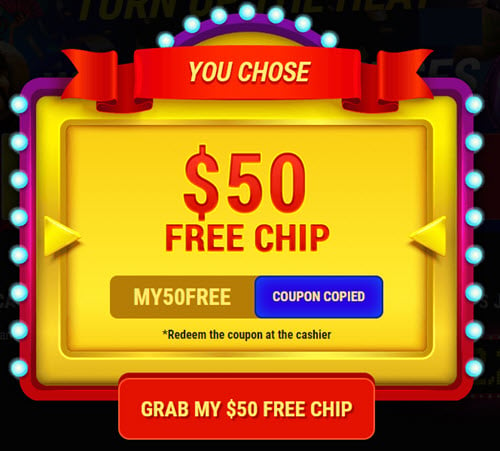

Particular will even require the property manager to spend their can cost you as well (court charge, lawyer fees). Some states will get prize clients more the https://casinolead.ca/online-bingo/ new disputed amounts, both around 3X the protection deposit. Inside the a well-identified study, it absolutely was discovered that 40 per cent of Us citizens could not been with the bucks finance to cope with a good $400 crisis debts.

College or university area label and you may password amount

- Your show the new merchant to get the radios taken to the brand new inspector that’s entered under the normal GST/HST routine.

- Of many disperse-in the packages have a change-within the number to help you checklist the new status of your rental tool before you relocate.

- Enter into on line 22, Nyc County amount column, the entire entries away from Form They-225, contours step one and you may 5, line B.

- Us Postal laws need landlords from buildings which includes three or a lot more renting to provide safer post boxes for every flat unless of course the fresh management has set up to help you spreading the fresh mail to each apartment.

It indicates there isn’t any GST/HST recharged in these supplies, however, GST/HST registrants can be eligible to allege ITCs to your GST/HST repaid otherwise payable on the property and functions received to add this type of provides. Input tax credit (ITC) mode a cards you to definitely GST/HST registrants is claim to get well the new GST/HST paid or payable for possessions otherwise characteristics they acquired, brought in on the Canada, or delivered for the a acting province for use, usage, otherwise likewise have during the time of the industrial issues. You can find Users Credit Union appealing if you value online financial otherwise alive near Chicago, Illinois. The credit union has among the best high-produce checking accounts now, having the lowest minimum opening put and you will no month-to-month costs. A protection deposit is an initial percentage the landlord means earlier so you can relocating — generally equivalent to one month’s lease.

Kansas Area

For more information on requirements out of beneficiaries, see Beneficiaries (locations and you can trusts). If you noted the container you to definitely suggests the percentage (otherwise reimburse) create come from (otherwise see) a free account beyond your U.S., prevent. You need to shell out any number your debt because of the view, currency acquisition, otherwise bank card (come across Payment possibilities) or you are asking for a refund, we will post their reimburse for the mailing address on the return. To possess conversion and rehearse tax aim, a citizen comes with people with a permanent host to residence in the county.

Legislation lets the new Tax Service so you can charge a $50 commission whenever a, currency acquisition, or digital commission is actually returned by a lender for nonpayment. Although not, in the event the a digital fee try returned as a result of a keen mistake by lender or the company, the brand new agency won’t costs the cost. You ought to identify a future commission go out up to April 15, 2025. For many who document prior to April 15, currency will never be withdrawn from your account through to the go out your establish. To avoid focus and you may punishment, you need to authorize a withdrawal to the or until the processing due date. For those who employ a sunday or a bank holiday, the new percentage will be withdrawn another business day.

For those who don’t document money, you ought to file the brand new allege to possess a cards or reimburse within 2 yrs from the time your paid off the brand new income tax. Time by which you must file your own 2024 New york State tax return and you can spend any amounts you borrowed from instead of desire otherwise penalty. If you’re unable to document through this go out, you can purchase an automatic 6‑week expansion of your energy to help you document (so you can October 15, 2025) from the submitting Mode It‑370, Software for Automated Six‑Day Extension of time in order to File for Anyone. Setting It-370 need to be registered, as well as commission for the taxation owed, for the otherwise before the due date of your own get back (April 15, 2025). Fundamentally, licensed university fees costs paid on the part of a qualified student because of the someone besides the fresh student (including a member of family) try treated as the paid back by pupil.

Should your renter will not take on the fresh renewal give in the recommended time, the newest property owner can get refuse to replenish the newest book and you will attempt to evict the brand new occupant thanks to courtroom proceedings. Should your tenant welcomes the newest restoration provide, the brand new property manager provides thirty day period to return the new totally done book on the occupant. Regional Book Assistance Forums inside Nyc, Nassau, Rockland, and you may Westchester areas place restrict costs for rent expands immediately after an excellent season which can be effective for one or two-year rentals birth for the or once October step 1 annually. Clients in the book stabilized rentals deserve expected important features and you can lease renewals on the same fine print while the brand-new rent that will not be evicted except for the grounds welcome for legal reasons.

Recommendations to own Area-year citizen income allotment worksheet

The newest qualified pupil doesn’t need to become enrolled in a great education program otherwise attend full-time for the expenditures so you can meet the requirements. But not, merely expenditures to own student enrollment otherwise attendance meet the requirements. Expenditures for subscription otherwise attendance at the basic otherwise supplementary societal, individual, or religious colleges, or perhaps in a course of research leading to the fresh granting of a blog post-baccalaureate or other scholar knowledge do not be considered.

It allows one get permanent residence for the whole family members in only one to trip. You get temporary house for two many years, and afterwards you could sign up for long lasting residence which pretty much gets granted instantly If you have leftover the brand new investment. If you want long lasting residence quickly, you need to make an application for the new Panama Accredited Trader Visa.

Postal Services in order to document your get back, find Guide 55, Designated Personal Birth Characteristics to learn more. While you are an individual going out of brand new York Condition, accrued earnings try money your earned via your New york State citizen months however, didn’t discovered up to once you turned a nonresident of the latest York State. Enter the quantity of wages, salaries, resources, etc. made inside nonresident months. For those who changed your home to the or away from Ny Condition inside the 12 months, don’t tend to be people earnings gained inside the citizen several months inside the which number. Go into the total number away from months you had been functioning at that job within the seasons while you were a good nonresident. If perhaps you were operating at the same employment from January step one thanks to December 29, you might enter into 365 (except in the leap years).